From Zero to Financial Freedom: Why Your Mindset Matters More Than Your Money

How I Discovered the Truth About Building Wealth (And Why Most People Get It Wrong)

When I started on Substack in January 2025, I had no idea what to expect. But the responses to my investment posts revealed a pattern I've seen countless times before - people focusing on what they lack rather than what they can build.

"You need money to make money."

"I have a job, kids, and a mortgage."

"I don't have enough time."

I hear you. I really do. But here's the uncomfortable truth I've learned from years in the investment world: What separates financially successful people from those who struggle isn't their starting point - it's their mindset.

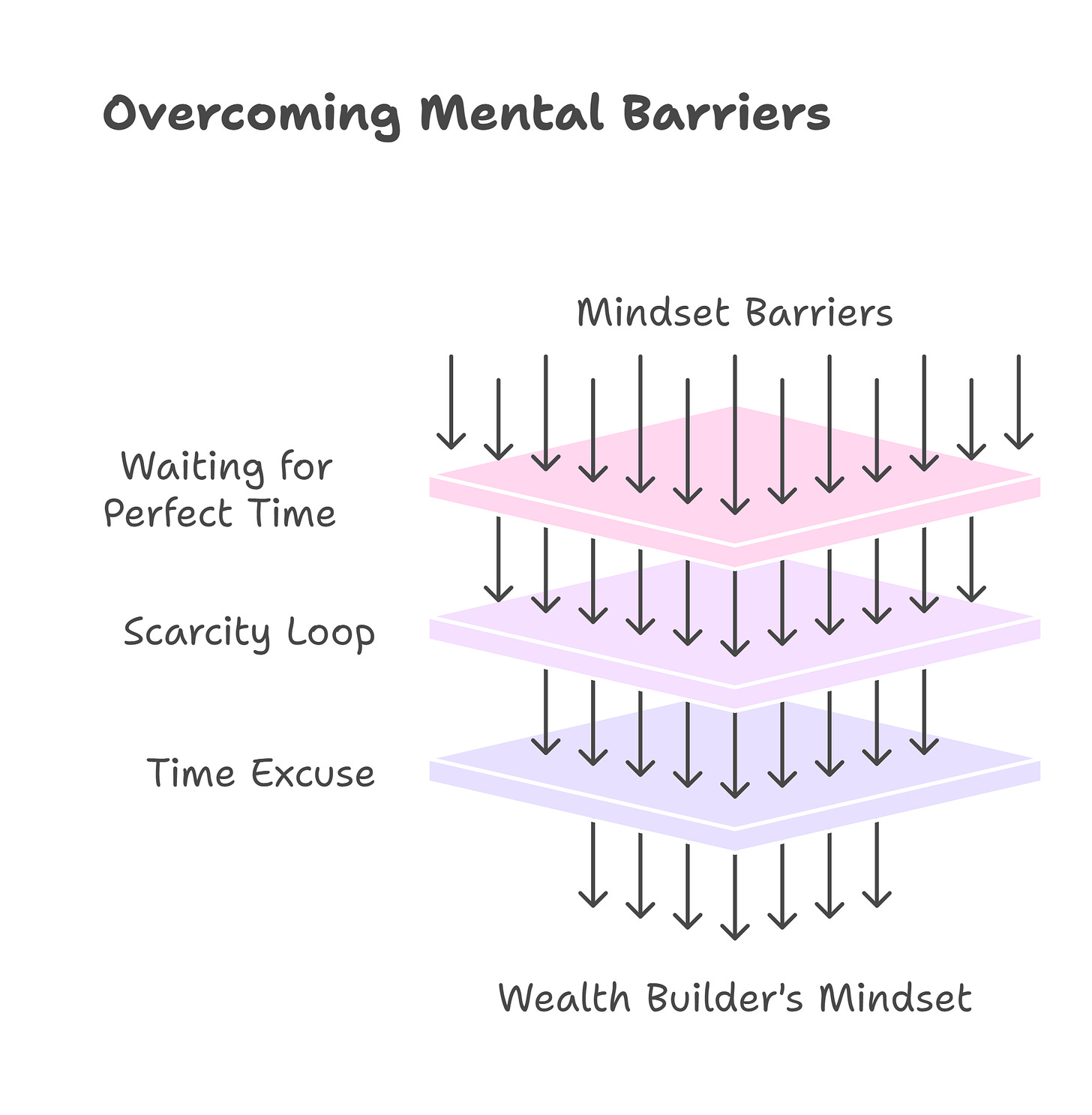

The Real Problem Isn't Money - It's Your Mental Barriers

Think about this for a moment: While you're worrying about not having enough to invest, thousands of people with the same salary as you are building wealth right now. The difference? They've adopted what I call the "wealth builder's mindset."

Let me break down what's really holding most people back:

The "Perfect Time" Trap You're waiting for the perfect moment when you'll have "enough" money to start. That moment never comes. I've seen people with $100,000 use the same excuse as those with $100.

The Scarcity Loop You focus on what you lack instead of what you can create. This mindset keeps you playing small, making safe choices that feel comfortable but keep you stuck.

The Time Excuse: Let's Get Real

"I don't have time" is the most common excuse I hear. So let's do a quick reality check:

Social media usage averages 2.5 hours per day

Netflix binging: 1-2 hours per day

Mindless phone scrolling: 1+ hours

You don't lack time - you're just not treating it like the valuable asset it is.

Your Real Path to Financial Freedom

Here's what most "financial gurus" won't tell you: You don't need to quit your job or risk your life savings to build wealth. What you need is a systematic approach:

Start Where You Are

Even $50 monthly in index funds is better than nothing

Use your expertise from your current job to create value

Build systems, not goals

Leverage Your Knowledge Don't fall into the trap of starting something completely new. Your biggest asset is what you already know. If you're an accountant, start there. If you're in IT, use that knowledge.

Think in Bulk This is crucial: Stop thinking about making money in small increments. Start thinking about scalable systems. Whether it's investments, side businesses, or career growth - scale matters.

The 2-3 Hour Solution

You say you have 2-3 hours free per day? Perfect. Here's how to use them:

First 30 minutes: Learning (focused on your field of expertise)

Next hour: Building your system (whether it's investment research, content creation, or skill development)

Remaining time: Execution and refinement

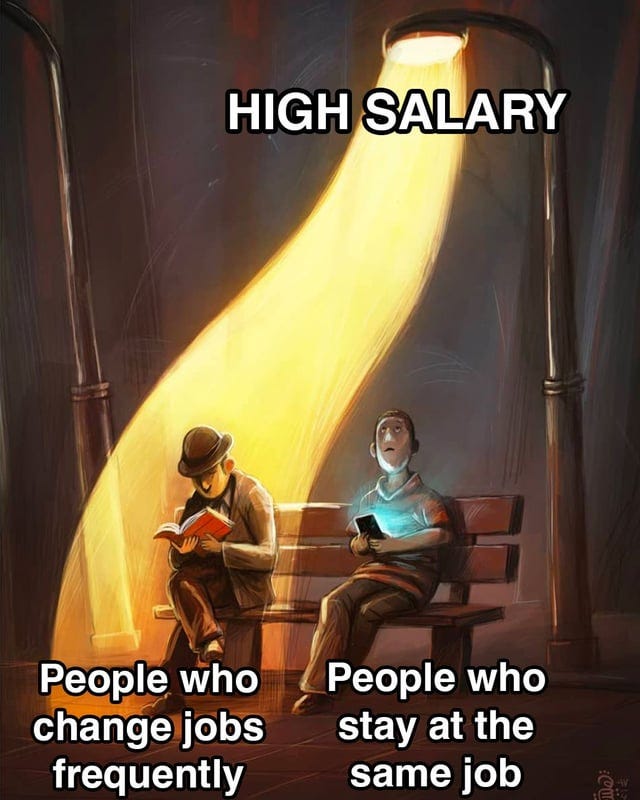

Breaking Free from the Salary Trap

Here's something most people don't realize: Staying in the same job, hoping for that annual raise, is the slowest path to wealth. The math is brutal:

Most employees get just 2-3% annual raises (often below inflation)

10 years at the same company = ~30% total increase

Real purchasing power actually decreases over time

But here's the game-changer:

One strategic job change can bring 20-30% instantly

A well-planned side business can add 50-100% to your income

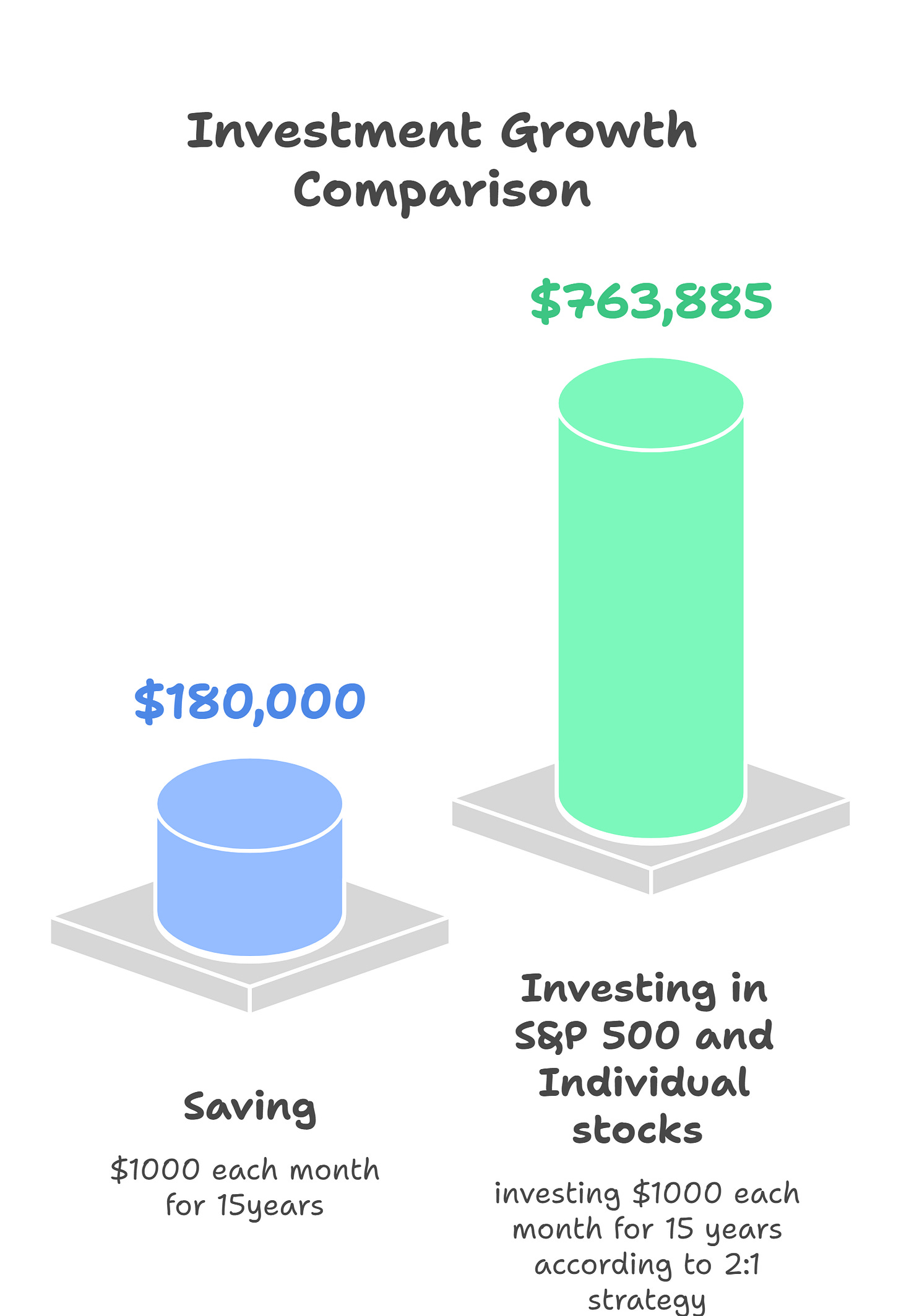

With this increased income, you can supercharge your wealth-building using the 2:1 investment strategy I discussed in my previous post - putting 2/3 of your investment money into index funds for stability, and 1/3 into carefully researched individual stocks for growth potential.

Smart Investing: Finding Balance Between Index Funds and Individual Stocks

Think about it: If you're currently investing $500 monthly, a 30% income boost could let you invest $650 instead. Add a side business, and you might reach $1000 or more in monthly investments. That's the real power of combining multiple wealth-building strategies.

Have you considered how much wealth you could build by investing $1000 monthly?

Is it an easy path? Absolutely not. You'll need discipline, consistency, and patience. There will be uncomfortable moments and difficult decisions. But remember - the reward isn't just at the end of the journey. Every step you take toward financial independence builds your confidence, your skills, and your wealth. The success and satisfaction come from staying on the path, even when it gets tough.

This is how real wealth is built - not through a single strategy, but by combining smart career moves, side income, and disciplined investing into a powerful wealth-building engine.

You might also like:

The Four Power Sectors Shaping the Next Decade: Your Guide to Future-Proof Investing

The Ultimate Guide to €5000 Monthly Investment Income: From High Risk to Royal Returns

If I Gave You €1M Today, What Would You Really Do With It?

Stay ahead of the curve - subscribe now to join our community of forward-thinking investors and wealth builders!

P.S. Remember: The best time to start was yesterday. The second best time is now.

If you enjoyed reading this post, please tap the Like or share button below ♥️

Thank you!

see ya, next time

Marjan

There's real wisdom in this article. Thank you.

This is the mindset shift people need—wealth isn’t about a perfect start, it’s about stacking small, smart moves consistently. The time and money excuses are real, but so is the opportunity to break out of them.