The Four Power Sectors Shaping the Next Decade: Your Guide to Future-Proof Investing

Why These Four Sectors Will Create More Wealth Than All Others Combined (And Most Investors Are Still Missing Out)

Here's a bold claim: Four sectors will dominate the next decade of investing. Miss these, and you're essentially stepping away from the biggest wealth-creation opportunity since the internet boom.

But unlike the dot-com bubble, these sectors are built on solid ground: real revenues, massive competitive moats, and unstoppable trends.

Semiconductors: The Digital World's Foundation

Think about this for a moment:

Nothing in our modern world works without chips. Your phone, car, smart home devices – even your coffee maker. But here's the kicker: Only a handful of companies can actually make advanced chips.

Why this matters more than ever:

Global chip demand grows 15% annually

It takes $20+ billion and 5+ years to build a single advanced chip factory

Governments are pouring unprecedented money into this sector ($52.7B from the U.S. alone)

The real opportunity? Companies like ASML that have an unbreakable monopoly in chip-making equipment. Without their machines, you simply can't make advanced chips. Period.

Cloud Computing & Cybersecurity: The Digital Fortress

Here's something wild: Companies now spend more on cybersecurity than on their actual computers. Why? Because a single breach can destroy decades of business overnight.

The beautiful part:

Companies pay every year (recurring revenue)

Switching costs are enormous (try changing your company's entire tech stack)

Profit margins often exceed 80%

Demand grows regardless of economic conditions

Healthcare Tech: The Silent Revolution

Forget traditional healthcare stocks. The real opportunity lies in companies transforming how healthcare works. Think surgical robots, AI diagnostics, and digital health platforms.

Why this sector is unstoppable:

Aging global population (guaranteed demand growth)

Massive inefficiencies ripe for disruption

Heavy regulation creates high barriers to entry

Tech integration is no longer optional

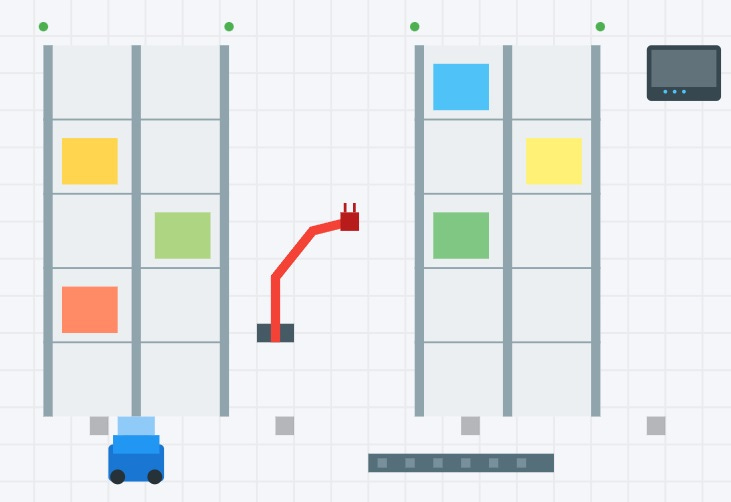

Warehouse Robotization: The Fourth Industrial Revolution

Here's the sector others aren't talking about enough: warehouse automation. E-commerce isn't just growing – it's exploding. And with labor costs rising and delivery expectations shortening, robots aren't just nice to have – they're essential.

The numbers tell the story:

Global warehouse robotics market expected to reach $25.8B by 2028

Amazon alone operates 520,000+ warehouse robots

Labor costs up 40% since 2020

ROI on warehouse automation: often less than 2 years

Why This Matters to You

These sectors share three crucial characteristics:

They're essential to modern life

They have massive barriers to entry

They generate real profits now (not just future promises)

How to Play This Smart

Here's your action plan:

Start with sector ETFs (lower risk, broad exposure)

Consider individual companies once you understand the space

Think long-term – these are decade-long trends

Stay informed about technological advances

The Bottom Line

This isn't about getting rich quick. It's about positioning your portfolio where the world is heading, not where it's been. These sectors aren't just growing – they're becoming more crucial every year.

Miss these, and you're missing the backbone of the future economy. It's that simple.

Want to learn more? Drop a comment below with your questions about any of these sectors.

Stay in the loop and never miss our latest insights

Subscribe now to join our growing community of forward-thinking professionals!